Course Contents

This course provides a detailed exploration into the critical intricacies of determining an organization’s cost of capital. Tailored for students aiming for a comprehensive grasp on finance, it seamlessly blends essential theoretical knowledge with practical applications, ensuring a clear understanding of the pivotal roles played by debt, equity, and the weighted average cost of capital (WACC).

After studying this course, you will be equipped with the nuanced understanding of the cost of capital required in the world of investment banking and finance. They will be primed to address real-world challenges with analytical rigor.

Selected Previews

Unlock Your Potential

Lessons Overview

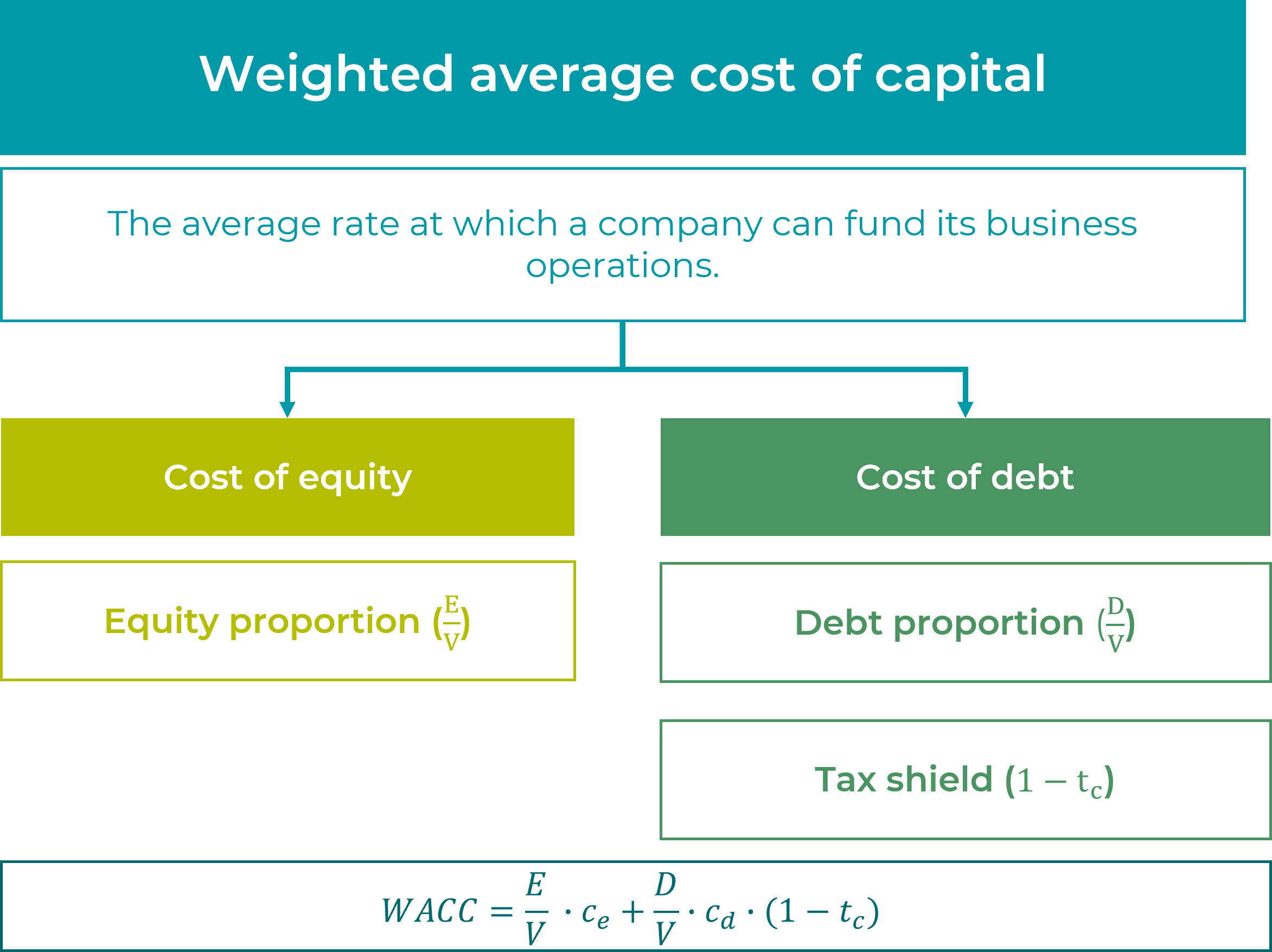

In this course you will learn the basic concepts of calculating the Weighted Average Cost of Capital.

The course consists of the following subjects.