Course Contents

This course offers a deep dive into the world of financial modelling. The course aims to empowering students to construct adaptable and driver based three-statement models in Excel, primed for DCF valuations. With a blend of fundamental knowledge and hands-on applications, it serves as a springboard into advanced financial analytics.

By the end of this course, you will not only possess a solid foundation in financial modelling but also the ability to employ these models practically, enhancing their decision-making capabilities in the realm of finance.

Selected Previews

Unlock Your Potential

Get access to Kepsfield Academy's unique adaptive learning environment with comprehensive theory, videos and adaptive quizzes on 5 different levels.

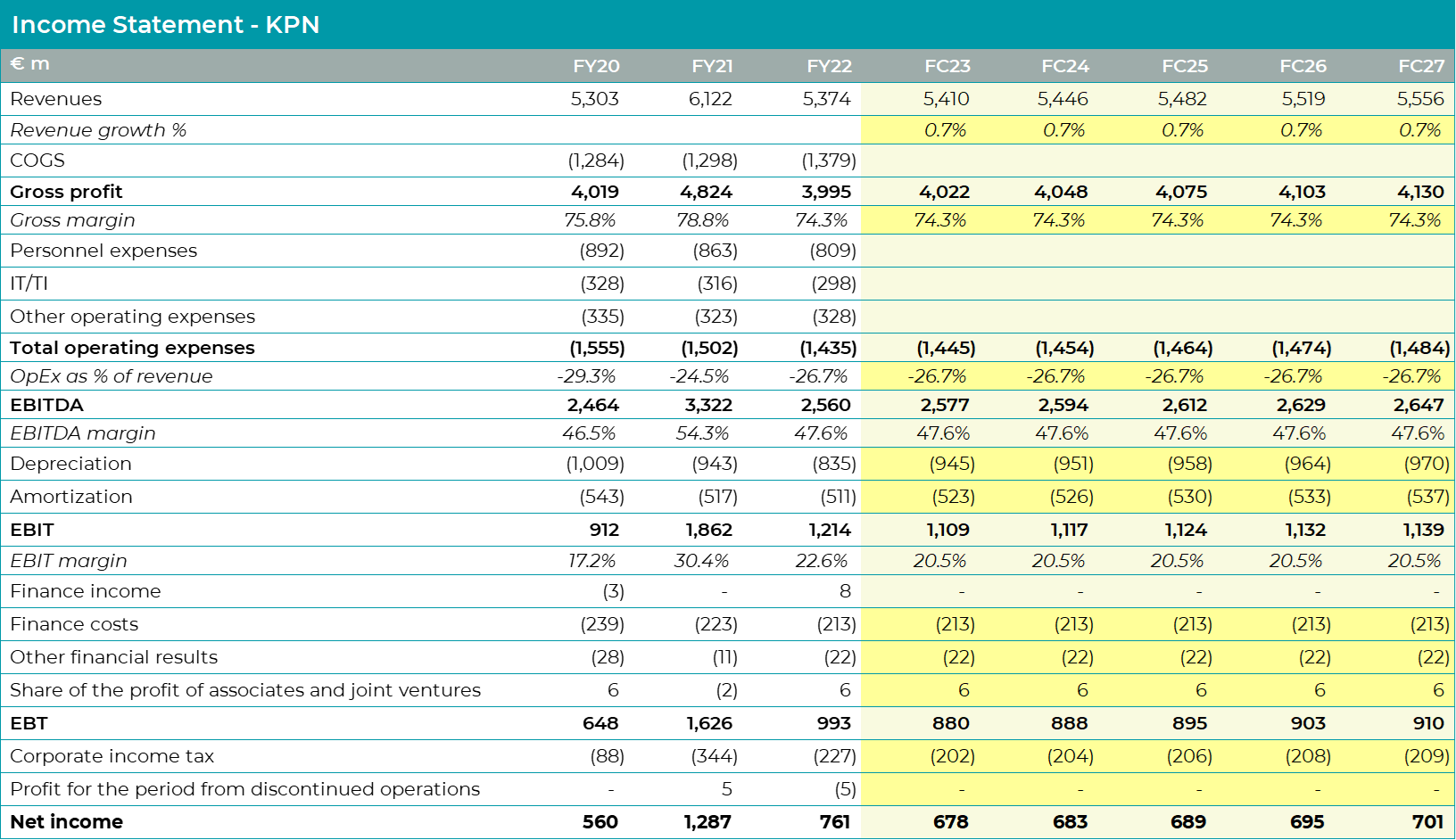

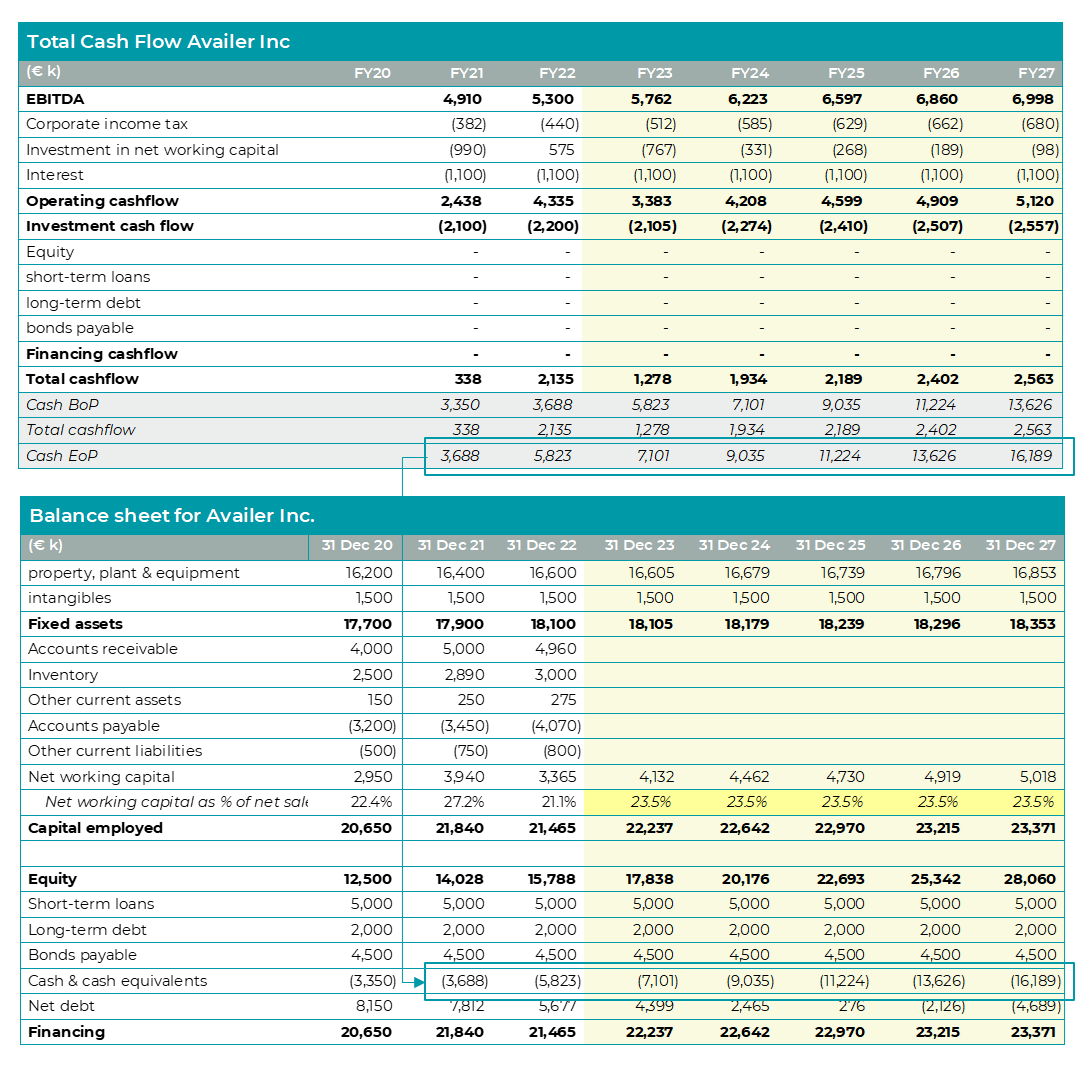

Get guided through the process of creating a flexible and driver based three statement financial model, learn how to calculate sensitivities and create reports from model outputs.

Get access to the Kepsfield Academy resource hub with multiple excel financial models to practise with, use reporting templates and excel templates for visualization and storytelling.

Lessons Overview

This course will provide you with a solid foundation in building complex financial models that can be used for valuation purposes.

The course consists of the following subjects.

Lesson 1: Course Outline & Introducing the Case Study

Lesson 2: Introduction to Financial Modelling

Lesson 3: Excel Essentials for Financial Modelling

Lesson 4: Understanding Financial Statements

Lesson 5: Building a Financial Model in Excel

Lesson 6: Discounted Cash Flow Modelling

Lesson 7: Financial Modelling for Valuation

Lesson 8: Financial Modelling for Decision Making

Lesson 9: Advanced Financial Modelling Concepts

Lesson 10: Financial Modelling Best Practices and Ethics

Lesson 11: Final Project: Building a Comprehensive Financial Model