Course Contents

This course is a comprehensive course that takes students through the fundamentals of the value of bonds, stock and the discounted cash flow valuation.

Beginning with financial statements and the importance of cash flow, the course progresses to concepts such as time value of money, discount rates, and terminal value. The curriculum then applies these principles to real-world scenarios, focusing on how DCF is used.

With a combination of lectures, case studies, and practical exercises, students will gain a robust understanding of DCF, equipping them for a range of roles in finance and investments.

Introduction to valuation – selected Previews

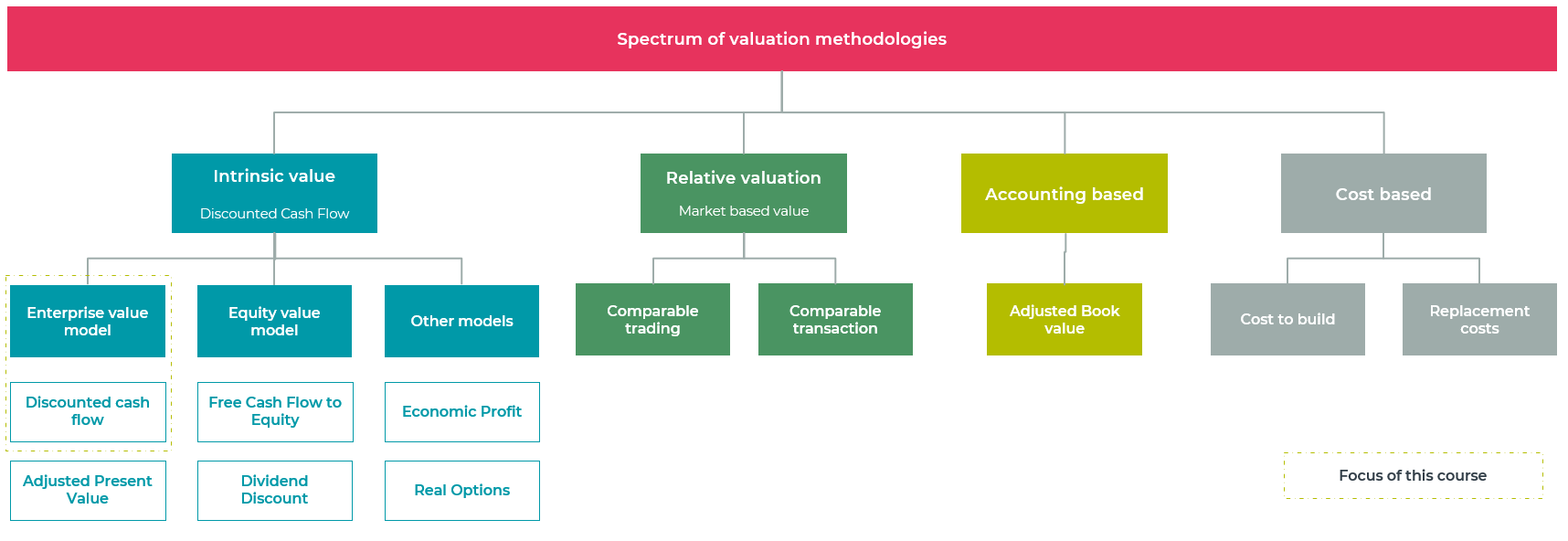

Spectrum of valuation methodologies – Kepsfield Academy

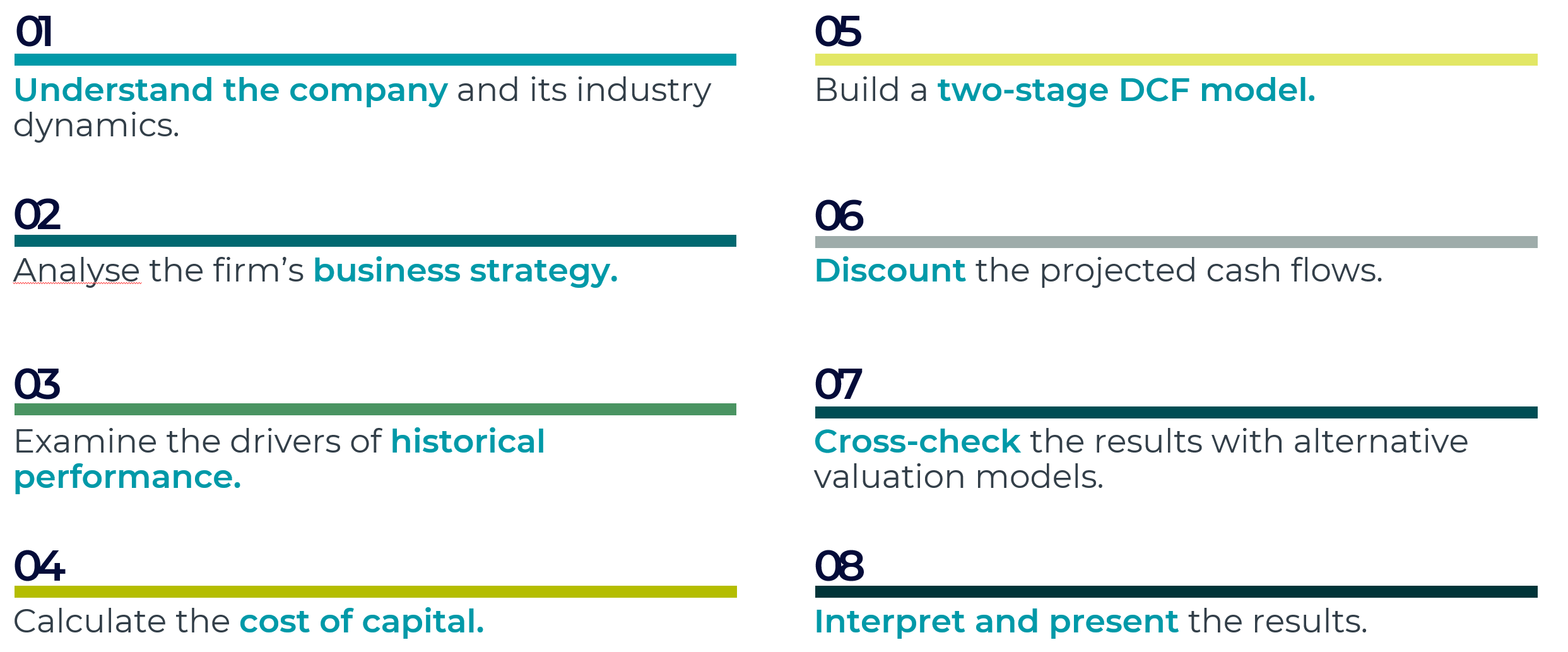

Eight steps of the DCF valuation – Kepsfield Academy

You might want to check our playlist on this subject!

Unlock Your Potential

Lessons Overview

In this course you will learn the basic concepts of business valuation.

The course consists of the following subjects.