Course Contents

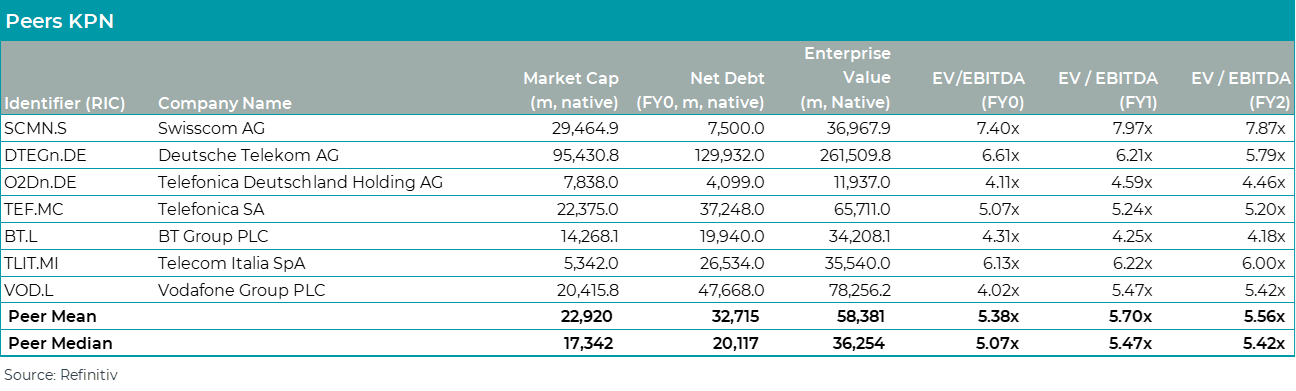

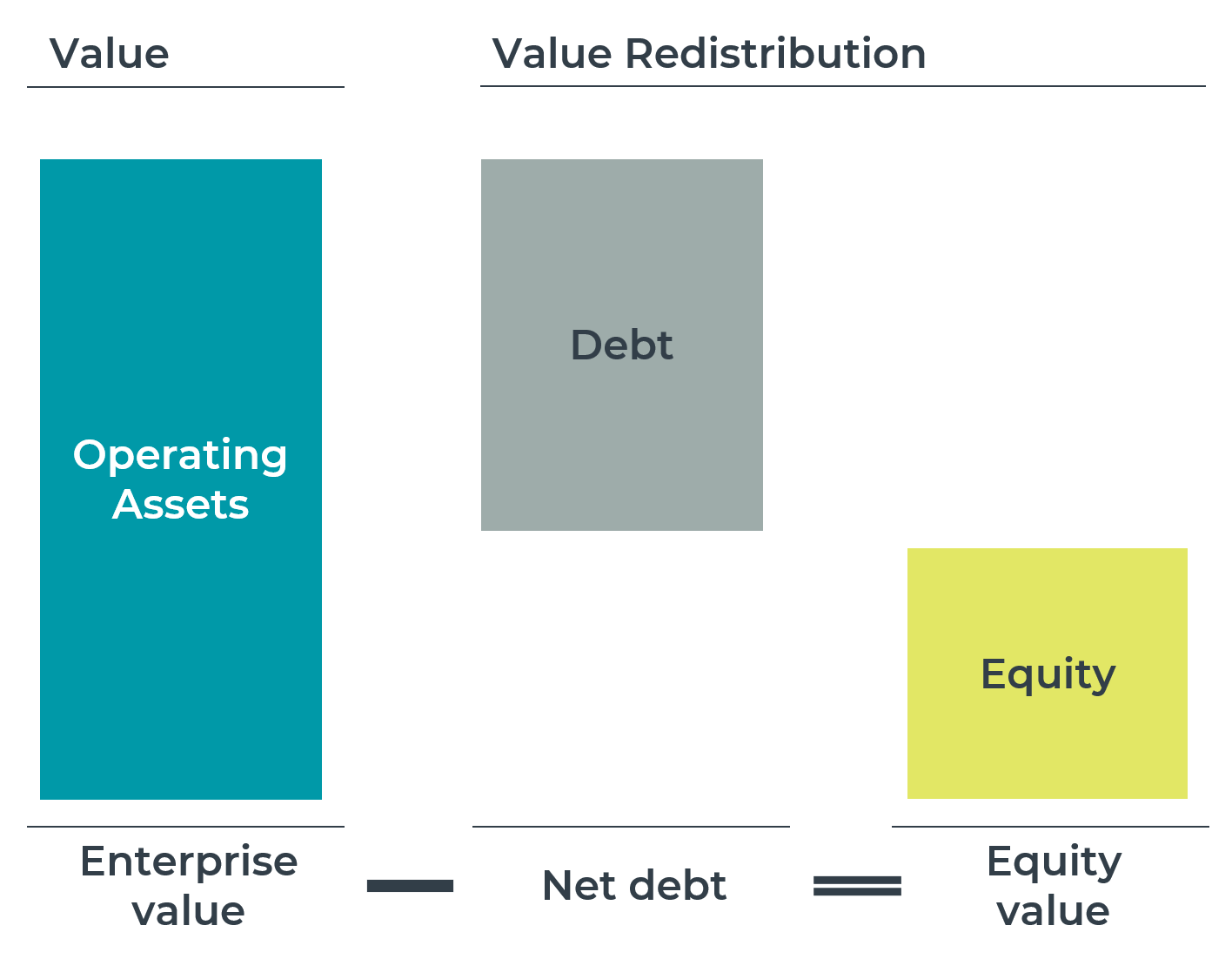

This robust course offers a comprehensive study of relative valuation. Both the comparable trading analysis and the precedent transactions will be detailed. The course begins with an overview of valuation methods and a deep dive into the principles of relative valuation.

The course navigates through the two key valuation concepts, including various valuation ratios.

Participants will learn to select appropriate comparable companies and transactions and will examine the application of relative valuation with special attention given to its role in mergers and acquisitions.

Using case studies to bolster practical comprehension and adjust anomalies where necessary.

Selected Previews

Unlock Your Potential

Lessons Overview

In this course you will learn the basic concepts of Relative Valuation including comparable trading analysis and comparable transactions analysis.

The course consists of the following subjects.