Just 6 Simple steps to Calculate Asset Beta in Excel! Hello finance students and recent graduates! You’re here not just about saving money, but also to solve a problem. Or even more dramatic: empowering yourselves with a crucial skill in finance – calculating stock beta. For this you don’t always need fancy tools or expensive resources to get the job done. Let me share a method that’s helped me, without the need for expensive databases. Excel only!

6 Simple steps to Calculate Asset Beta in excel

Asset Beta definition

Beta is a measure of a stock’s volatility compared to the overall market. In simpler terms, it tells us how much a stock’s price jumps around compared to the market. For example, a beta of 1.5 suggests that the stock is 50% more volatile than the market.

As finance students and graduates, the asset beta calculation is essential. It’s a key component in portfolio management, risk assessment, calculating a discount rate, WACC or cost of capital. It was during my student days that I first needed to calculate an asset eta in the middle of the night without any databases, and it turned out to be a relatively easy 6-step process, derived from the asset beta formula:

Asset Beta formula

Traditionally, beta is calculated using regression analysis with historical stock prices and market returns and it is directly retrievable from databases as FactSet, Refinitiv or CapitalIQ. This often requires access to expensive financial databases – a barrier for many of us in the early stages of our finance careers. So we created s simple 6 step plan to calculate Beta.

6 Simple steps to Calculate Asset Beta

You can calculate beta using free, publicly available data and tools like Excel. It’s a method that’s both accessible and educational:

First, pick your stock you want to calculate and retrieve a 5 year monthly stock adjusted closing price data in Excel. This frequency strikes a balance between capturing long-term trends and ensuring the data is manageable. Use Yahoo Finance. Make sure you end the historical data on your valuation date!

- Second, pick your index and retrieve a 5 year bi weekly stock data for exactly the same dates.

- Next, in Excel, calculate the stock’s returns and the market’s returns. Simply use the formula (New Price – Old Price) / Old Price.

- Then, use the SLOPE function, where your stock’s returns are the dependent variable, and the market’s returns are the independent variable. The result? Your stock’s beta!

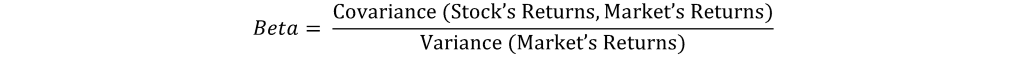

- Check your calculation: calculate the covariance of the stock return with your index return and divide it by the variance of the index return.

- Double-check your data sources and calculations. Remember, garbage in, garbage out. Accuracy is key.

Key tip: select the appropriate market index

So choosing the correct market index is key here as it will impact the outcome of your beta calculation. So

- Choose an index in the same currency as your stock to avoid currency risk distortions.

- Select an index that represents the stock’s market. For a Indian stock, the Nifty 50/100/200 is a good choice.

- Ensure the index aligns with your stock’s risk characteristics. For a tech stock, an index heavy with tech companies, like the NASDAQ, might be more representative than a broad market index.

Download asset beta calculator

Imagine calculating the beta for Reliance (RELIANCE.NS) against (our simple choice) the Nifty 50 as of 31st december 2023. You can download this calculation below. By doing this calculation, I can hand you the following practitioner tips:

- Check if all stock data is in INR.

- Use the adjusted closing data to capture all value accreditations

- Use the Covariance.S and variance.s formulas to capture the entire sample

SPOILER ALERT! The outcome of our calculations is 1.024. For comparison, the Refinitiv database indicates a beta of 1.03. So this is absolutely a very good calculation.

Levered versus unlevered beta

For the curious ones: we have now calculated the levered beta. The levered beta depicts a stock’s volatility considering the capital structure of the specific company, reflecting the true investment risk. The unlevered beta, on the other hand, disregards the impact of the capital structure, showing the stock’s volatility due to its business activities alone, making it useful for comparing companies with different capital structures.

Want to know more?

So now you know the 6 Simple steps to Calculate Asset Beta in Excel. Free download!

Buy our case-based training on this topic! You can find these here.

If you want to see our animation about the beta and its role in determining the cost of captial, take a look here: