In our day-to-day operations at the M&A consultancy, we encounter a variety of valuation assignments that are crucial for our clients. These assignments require different valuation techniques. Amongst these various techniques, we often rely on the Discounted Cash Flowvaluation analysis, which serves as a compelling tool.

Table of Contents

Too long; didn’t read?? Watch our Youtube animation on this subject:

In this blog post, we will embark on a journey to demystify the discounted cash flow valuation, delving into its four key elements, and the fundamental steps involved in such a valuation. Whether you are an aspiring financial analyst or an investor seeking insights into the world of finance, this article is tailored to provide you with a comprehensive overview of this kind of valuation.

Download DCF valuation model

Download of free and straight forward excel template. This is a very good beginner level model you can start using immideately. Make sure you read this blog post as an introduction. If you really want to learn how to do this type of valuation, do our course on this subject.

Four Essential elements of the DCF valuation

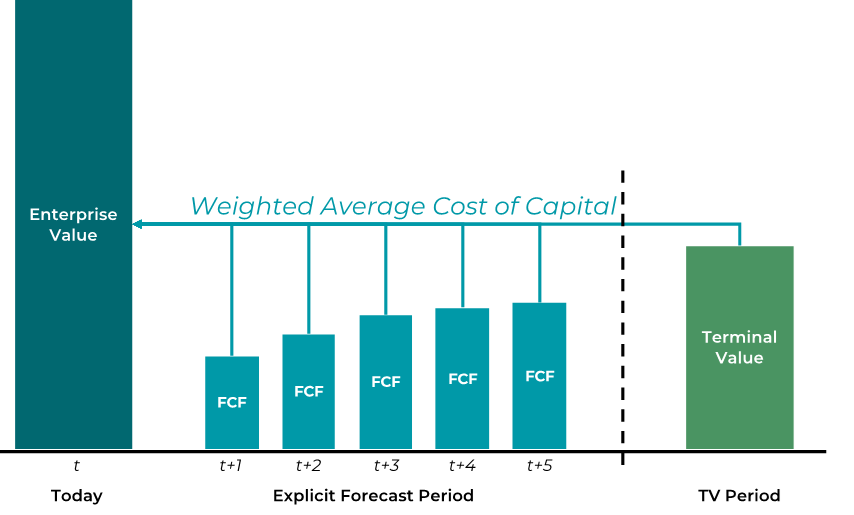

Our learning journey begins with a fundamental understanding of the DCF valuations, which is a method used to determine the intrinsic value of an asset or company by analyzing its expected future cash flows.

Key element 1: Free Cash Flow

Free cash flows represent the economic benefits the providers of equity and debt can receive. They are calculated by deducting expenses and investments from cash received from clients. Moreover, they are are at the heart of the DCF analysis as these amounts are translated into the value of the company. Check our blog on the calculation of the free cash flow here.

Key element 2: Explicit Forecast Period

This is where we start — forecasting FCFs over a specific timeframe. Generally, it’s a five-year horizon, during which we estimate all possible future cash flows based on historical performance and industry analysis. It’s the foundation of the DCF valuation. We have a full blog on which techniques to use and how to forecast the free cash flows of the explicit forecast period.

Key element 3: Terminal Value

We always hope that our client’s company will last forever, but we can’t predict forever, right? So, we calculate the present value of cash flows beyond the explicit forecast period, assuming the company will keep generating cash. This is called the terminal value often accounts for a significant portion of a company’s total worth. It is key that the free cash flow of the terminal value mimics a steady state of the company.

Key element 4: Weighted Average Cost of Capital

Investors, whether equity or debt holders, expect a return on their investment. WACC is the magic number—it combines the cost of equity and debt, considering the risk and financing instruments. It helps us bring future free cash flows to their present value. Interested in our blog on determining the WACC? Read here.

Mastery of these four elements empowers financial analysts and investors to determine the intrinsic value of companies or assets.

Four Easy Steps of the DCF

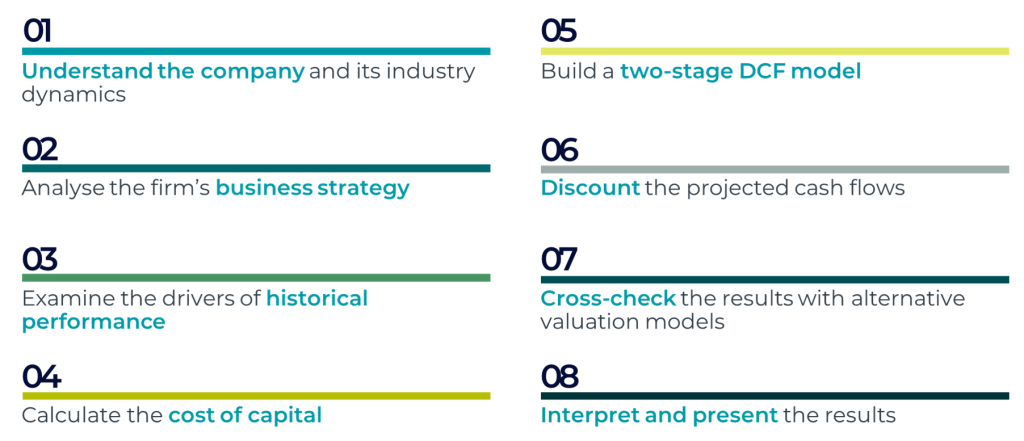

When composing a full valuation report, I always use the following eight steps. This guideline is also the one we use in our courses at Kepsfield Academy:

In this blog, we focus on step 5 and 6 (the technical part of the DCF) by diving into a real-world example. In four substeps we’ll unravel how to compose a two-stage DCF model and determining the intrinsic value of a company.

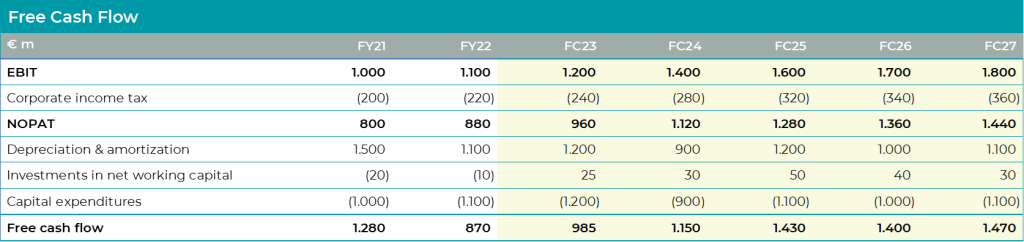

Step 1: Forecasting FCF’s of the Explicit Period

To smoothen your learning experience, I ‘ve already projected the company’s free cash flows for the explicit forecast period, spanning from FC23 to FC27 (again: read our blog on how to create this). Important note is that the final year resembles a steady state and that means that (ao.) depreciation and investments are equal.

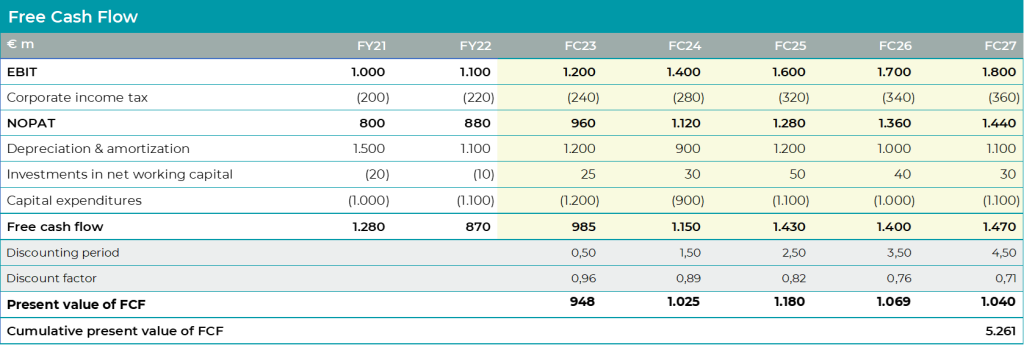

Step 2: Calculate the present value of the FCF in the Explicit Period

During this step, we translate the future cash flows into present values discounting these cashflow with the weighted average cost of capital.

– We apply mid-year discounting as the income and cash flows are evenly distributed throughout the financial year.

– The weighted average cost of capital is set at 8%.

A present value is calculated by discounting a future cash flow using the weighted average cost of capital. For this you use a discount factor. The discount factor is calculated by dividing one by one plus the weighted average cost of capitalto the power of the discount period. So for FY23 we calculate:

We then multiply this number by the FY23 free cash flow to arrive at the present value of €948m in FY23.

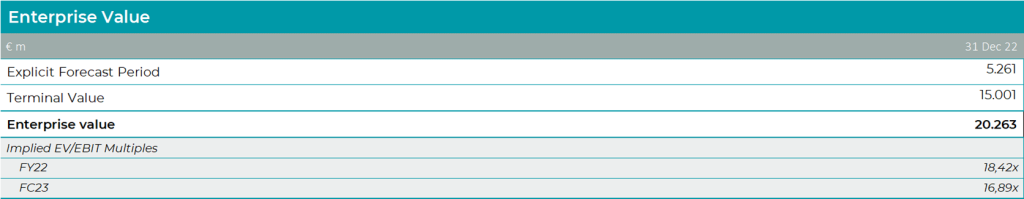

Using the net present value formula for the other years as well, we compute the net present value of the company’s 5-year forecasted free cash flows, totaling to €5,261m.

Step 3: Calculate the Terminal Value

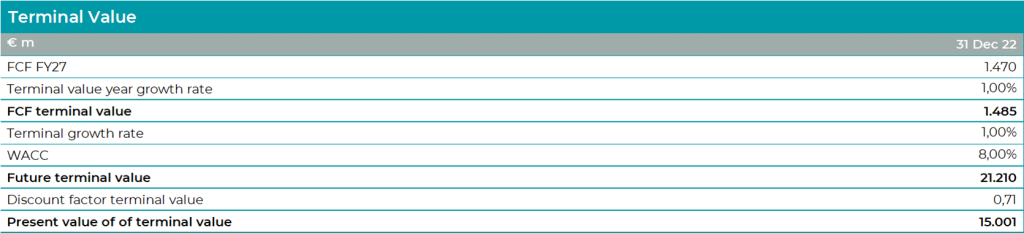

Next, we calculate the terminal value free cash flow, considering a terminal growth rate of 1.00%. I proxied the terminal value growth rate to the average latest 10-year European GDP growth rate of 1.00%.

We multiply the free cash flow of the final forecast year by 1.01 to arrive at €1.485m

The terminal value FCF is then divided by the difference between weighted average cost of capital and a terminal growth rate, yielding the company’s future terminal value. To calculate the present value , we discount this with the discount factor of the final forecast year. We reach the company’s fully discounted terminal value, amounting to €15,001m.

Step 4: Calculate Enterprise Value

The final step involves summing the net present value of the explicit forecast period and the terminal value, resulting in the company’s enterprise value of €20,263m.

I hope that by working through this Excel example, you’ll gain a hands-on understanding of how DCF valuation can be applied to real-world scenarios, enabling you to make informed investment decisions.

Conclusion

In conclusion, the DCF is a powerful tool that empowers investors and financial analysts to assess the intrinsic value of assets or companies by considering their expected future cash flows. I always advise cross-checking the results with alternative valuation techniques such as the multiple valuation, on which we have a blog and a course as well.