In advising our clients, it frequently starts with determining the total cash flow and free cash flow (FCF). Whether it is the creation of a business case, evaluation strategic directions, or a plain valuation, we always end up determining FCF. Why? FCF is most directly related to value. We rely on a diverse range of valuation methods among which the Discounted Cash Flow method is a prominent choice. We are going to provide a comprehensive understanding of the FCF, a vital component of modern financial analysis. You should be aware of this whether you’re an aspiring analyst or a seasoned investor. Here’s the tric to never doing it wrong again.

Table of Contents

Too long, do not read? Watch our Youtube animation on this subject:

Understanding Free Cash Flow: Cash is King

FCF is one of the essential elements of DCF valuation and one of the main financial definitions you should master, together with EBIT and EBITDA. It represents the cash generated by a company’s core operations that’s available to all capital providers, both equity and debt holders, after accounting for investments in working capital and fixed assets. It therefor excludes any impact from financing, which is the main differentiator with the regular cash flow of a company. FCF is a vital metric because it reveals a company’s true financial health and its capacity to reward investors. Interested in our blog on the key elements of DCF valuation? Read here.

Why is FCF Crucial for Valuation?

So, why do we (in the financial industry and consulting) use free cash flow a lot:

- Cash is key and FCF prioritizes cash. It is offering a more dependable indicator of company’s financial health compared to accounting profits.

- As a valuation is all about forecasting a company’s future cash flows, with FCF serving as its nucleus, providing insights into the company’s capacity to generate cash, an essential element in determining its true value. Our clients our always looking for ways to increase value.

- For our investor clients such as PEs, FCF is invaluable, representing cash available for distribution to shareholders, debt holders or reinvestment, making it a key metric for evaluating their investment returns.

The Formula for Calculating Free Cash Flow:

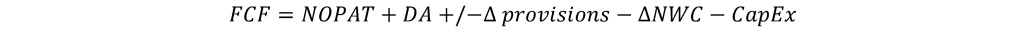

So how to calculate? The calculation of FCF involves several key components, and here’s the formula. The key thought here is to correct the income statement for all its non-cash expenses and take into account all the operating cash movements in capital employed (the balance sheet):

Now, let’s break this equation down step by step:

- Start with NOPAT: Net Operating Profit After Tax (NOPAT) is a crucial starting point. It measures a company’s operating profit after accounting for taxes, excluding financing costs. NOPAT represents the potential cash flow generated by a company’s core operations.

- Add Back Depreciation and Amortization (DA): These are the main non-cash expenses included in NOPAT that need to be added back as they don’t represent an outflow of cash.

- Adjust for Changes in provisions (Δprovision): Changes in provisions are non-cash expenses (or income) in NOPAT. An increase in provisions is triggered by a non-cash expense and should be added back to NOPAT. The opposite goes for a realease of the provision.

- Adjust for Changes in Net Working Capital (ΔNWC): Changes in working capital can significantly impact cash flow. An increase in net working capital represents an investment, reducing FCF, while a decrease increases FCF.

- Subtract Capital Expenditures (CapEx): Capital expenditures are investments in long-term operating assets like property, plant, and equipment (PPE). These investments reduce FCF as they represent a cash outflow.

How to never make a mistake in determining free cash flow

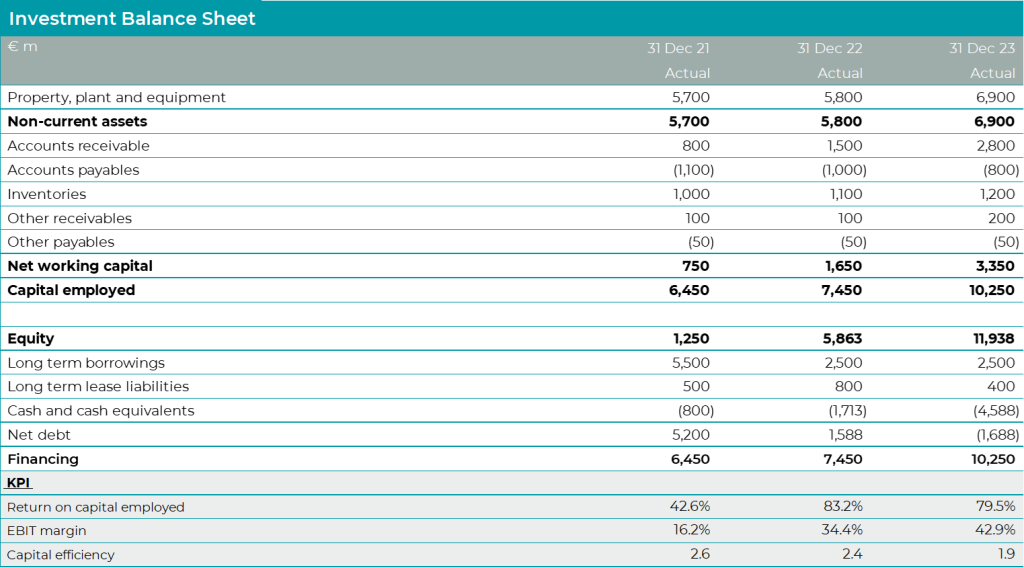

Top tip: first calculate total cash flow and reconcile this to the change in cash and cash equivalents on the balance sheet. The fundamental reason for calculating total cash flow before free cash flow indeed centers on ensuring accuracy in financial reporting and analysis. Starting with total cash flow allows you to reconcile the reported change in cash and cash equivalents on the balance sheet. This step is crucial for verifying that the cash flows from operating, investing, and financing activities have been accurately captured and reported. Only after confirming that these numbers reconcile correctly with the changes in the cash position on the balance sheet can you confidently proceed to calculate free cash flow (FCF).

A Case of Determining Free Cash Flow

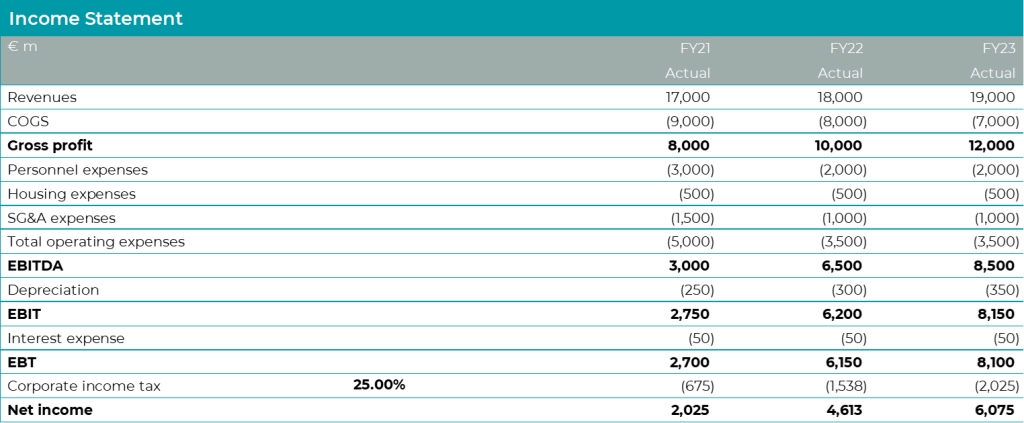

Let’s dive into a practical example of calculating free cash flow for a company for which we are preparing a DCF analysis for the years 2022 and 2023.

In this scenario the investment balance sheet is provided for the sake of focusing on the calculation of the free cash flow. Typically, we’d reorganize the accounting balance sheet to align it with the investment balance sheet structure, by categorizing various line items. In case you want to learn more about how to rearrange the items check our blog on the investment balance sheet.

One important note is that capital employed and financing should always balance out. To practise what we preach, we first calculate the total cash flow, in which we reconcile the total cash flow to the change in cash on the balance sheet. Now we know that we did not make any mistakes in our calculations.

We now have all information to calculate the free cash flow for each year in a step by step approach.

Step 1: Calculating Net Operating Profit After Tax (NOPAT)

To calculate NOPAT, we use the formula:

The corporate income tax rate (tc) is set at 25% in this example, while the EBIT for each year can be found on the income statement. Therefore:

Step 2: Adding Back Depreciation and Amortization

Depreciation and amortization are the main non-cash expenses, so we add them back to our calculation. In 2022, depreciation amounted to €300 million just like amortization. In 2023, depreciation and amortization both amounted to €350 million. To make it easy for yourself, create a PP&E corkscrew and reconcile all numbers to the balance sheet and income statement:

We’ll add that back to NOPAT.

Step 3: Calculating Change in Net Working Capital (ΔNWC)

We calculate the change in net working capital. We see that the net working capital increases over time from €750m (2021) to €1,650m (2022) to €3,350m (2023). Note that the increase in net working capital results in a negative cash flow. So we’ll subract NWC investment of € 900m and € 1,700 from NOPAT.

Step 4: Capital Expenditures (CapEx)

Finally, we calculate capital expenditures (CapEx) for each year based on the movement in fixed assets (property, plant, and equipment) and depreciation from the income statement. We can use the corkscrew again:

We can see that the CapEx amounts to €400m in FY22 and €1,450m in FY23.

Step 5: Calculating Free Cash Flow (FCF)

Now that we have all the necessary components, we can calculate the free cash flows:

I hope that this example was a good representation of how to calculate the free cash flows, enabling you to get a good understanding of a crucial element of the DCF valuation.

In conclusion, calculating Free Cash Flow is not just a financial exercise; it’s a skill that can open doors to better decision-making, whether you’re an investor or a business leader. Stay tuned for more insights and practical tips as we delve deeper into the world of valuation and finance.

Ready to master the art of Free Cash Flow calculation? Enroll in our course today and unlock the true potential of valuation!

Free model for calculating the free cash flow

Find our free template model for the calculation of the total cash flow and the free cash flow here! If you would like to learn modre, please use our course on DCF valuation.